Key takeaways

-

A crypto inheritance plan is crucial, as losing private keys or seed phrases can permanently render assets like Bitcoin, Ether, and NFTs unrecoverable.

-

A comprehensive inheritance plan should include asset inventories, clear access instructions, and a trusted executor to ensure heirs can safely and legally access holdings.

-

Privacy should be maintained using encrypted files, sealed documents, or decentralized identity tools, avoiding the disclosure of sensitive information in public wills.

-

Striking a balance between custodial and non-custodial solutions is essential for securing assets while facilitating transfers, preventing mistakes like storing everything on exchanges or sharing keys insecurely.

If you own cryptocurrencies such as Bitcoin (BTC) and Ether (ETH), it is imperative to establish a clear and well-structured inheritance plan to prevent your assets from becoming inaccessible after your passing.

Unlike traditional bank accounts, cryptocurrencies rely entirely on private keys and seed phrases (stored in either hot or cold wallets). Losing these keys results in permanent loss of assets. Annually, millions of dollars in cryptocurrency are lost due to forgotten passwords, misplaced wallets, or heirs unsure of how to access these assets.

Traditional wills often overlook digital assets, potentially leading to legal complications or total loss. A thoughtfully constructed crypto inheritance plan tackles these issues, ensuring your assets remain secure and accessible to your beneficiaries as intended.

This article explores the necessity of a crypto inheritance plan, its essential components, strategies to protect privacy during planning, crypto death protocols, and much more.

Why you need a crypto inheritance plan

If you possess cryptocurrency, establishing a crypto inheritance plan is vital. Cryptocurrencies are typically self-custodied, meaning only you hold the private keys or seed phrases. If you pass away without sharing this information, your assets may be irretrievably lost. A digital asset plan will ensure proper sharing of altcoins and Bitcoin private keys after your death.

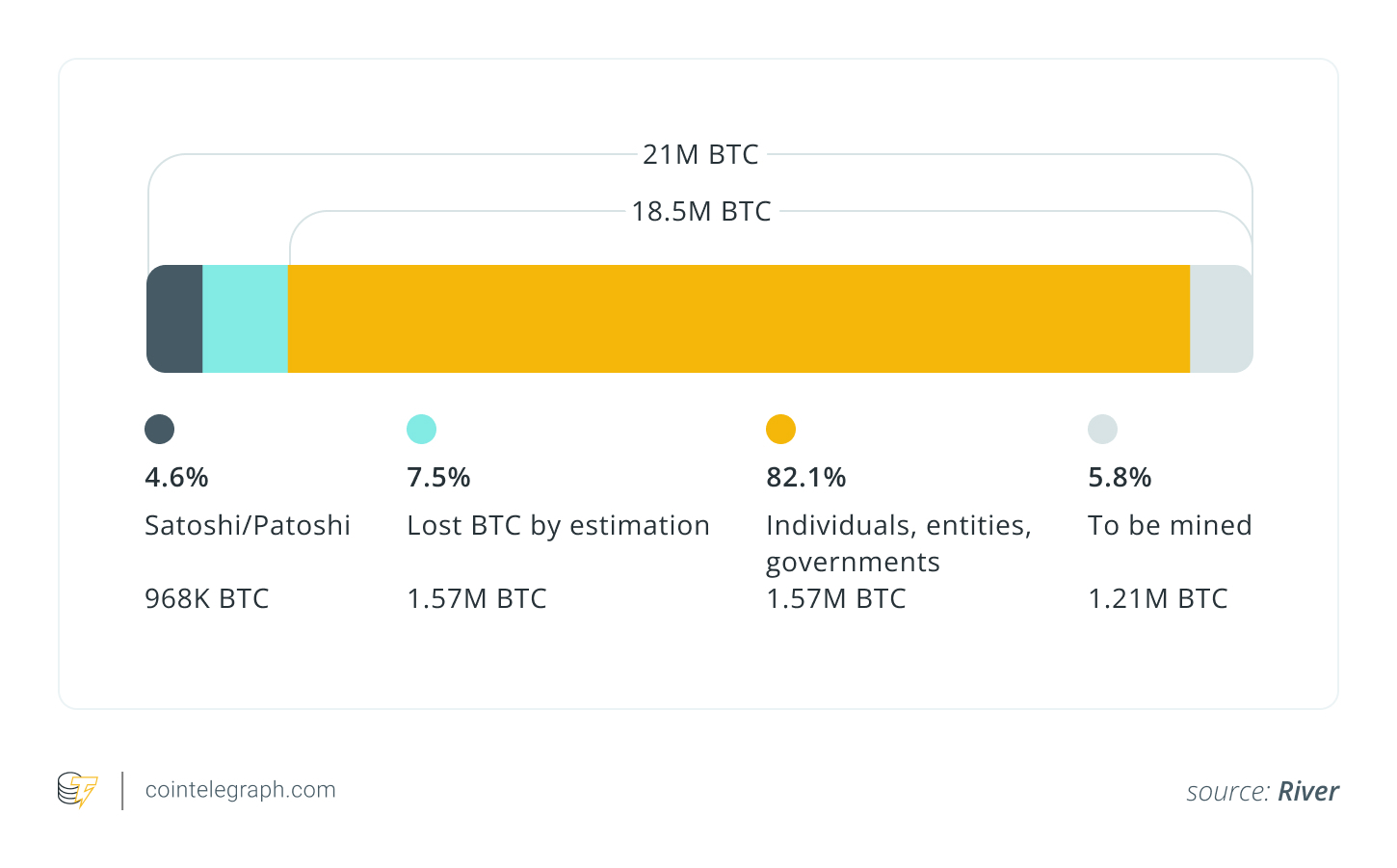

Approximately 1.57 million Bitcoin are believed to be lost, making up around 7.5% of the total supply of Bitcoin (limited to 21 million BTC). Traditional wills generally do not cover cryptocurrency requirements, and heirs might lack the technical skills needed to manage digital wallets.

Without effective crypto estate planning, your assets could become unrecoverable, leaving your family without support. A well-crafted plan ensures secure crypto transfer after your passing to your loved ones, clarifying what assets you hold, how to access them, and how to manage them responsibly. Transferring crypto isn’t just about wealth preservation; it safeguards your legacy in an evolving digital financial landscape.

Did you know? Crypto estate services provide features like multisignature recovery, secure identity verification, and smart contract-based wills, assisting investors in transferring their crypto to heirs without complications from lost access.

Prerequisites for building a secure crypto inheritance strategy

Creating a crypto inheritance plan is essential to protect your digital assets and ensure they are passed on to the right individuals, minimizing confusion or risk. Given the self-custodied and irreversible nature of cryptocurrency, a clear strategy can determine whether your legacy is preserved or lost.

Here are the core components to consider before designing your crypto inheritance plan:

1. Establish clear legal directives

Consult with an estate planning attorney knowledgeable about both inheritance law and digital assets. Your crypto should be specified in legally binding documents such as a will, trust, or letter of instruction.

Be explicit about:

-

Which assets are to be inherited

-

Who the beneficiaries are

-

How the assets should be accessed.

These documents help ensure your wishes are recognized legally and minimize the risk of disputes or legal obstacles later.

2. Secure and share private key access responsibly

The primary challenge in crypto inheritance is key management. Without your private keys or seed phrases, your beneficiaries cannot access your assets, and exchanges cannot assist in recovery.

Consider these options:

-

Utilize multisignature wallets requiring two or more private keys for transaction approval.

-

Distribute key parts among trusted family members or advisors using Shamir’s Secret Sharing.

-

Store recovery information in secure, tamper-proof locations (e.g., bank safe deposit boxes, encrypted drives).

Always document how and where to find the keys in a manner your heirs can understand.

3. Integrate smart contract automation (where supported)

In certain ecosystems, smart contracts can automate the inheritance process by initiating transfers when specific conditions are met, such as the presentation of verifiable death certificates or time delays. While not available on all platforms, systems like Ethereum offer programmable logic that can enhance legal planning.

Smart contracts should complement, not replace, legal documentation. Use them to enforce your wishes in a transparent and secure manner.

4. Educate your heirs or trusted executors

Even the most comprehensive inheritance plan may fail if your beneficiaries lack an understanding of crypto. Take the time to:

-

Document clear, step-by-step access instructions.

-

Explain wallet tools, basic security, and scam avoidance.

-

Designate a trusted, crypto-literate executor to guide the process.

You don’t need to disclose current balances, but education serves as a safeguard against future confusion, delays, or loss.

Did you know? One of the primary risks in crypto inheritance is forgotten credentials. Effective planning with encrypted backups or reliable executors could preserve cryptocurrency worth billions for future heirs.

How to write a crypto will

A crypto will ensures your digital assets are securely transferred to your beneficiaries while maintaining privacy and legal compliance. By meticulously documenting your assets and instructions, you can minimize risks and establish next-of-kin access to crypto.

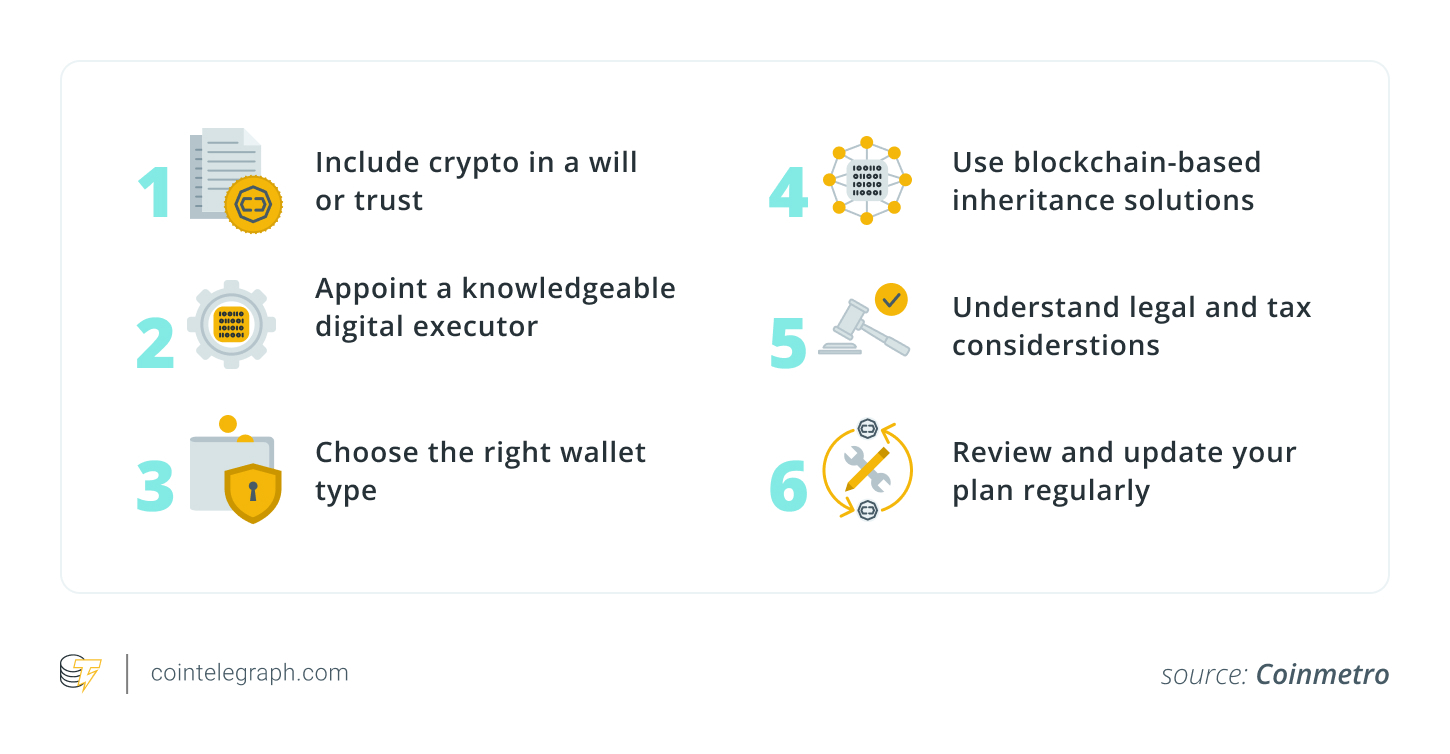

Here are several general steps to create a crypto will:

-

Compile a detailed inventory: List all digital holdings, including hardware and software wallets, exchange accounts, non-fungible tokens (NFTs), and decentralized finance (DeFi) investments, to provide a comprehensive overview of your assets.

-

Secure sensitive information: Do not include private keys in the will. Store them in encrypted files or hardware wallets, with access instructions referenced in the document.

-

Provide clear access instructions: Include detailed steps for your beneficiaries to access your digital assets securely.

-

Appoint a tech-savvy executor: Select a trusted individual knowledgeable about cryptocurrency or establish a trust to effectively manage the transfer process.

-

Ensure legal compliance: Confirm that the will adheres to local inheritance and tax laws to avoid disputes or complications.

-

Incorporate a digital asset memorandum: Consider adding a memorandum outlining specific instructions for your digital assets, enhancing clarity and security.

-

Use specialized services: Look into crypto inheritance services for added security and streamlined transfers for your beneficiaries.

-

Update regularly: Periodically review and revise the will to reflect changes in your assets or legal requirements, ensuring ongoing accuracy.

You should also consider potential inheritance tax implications on Bitcoin and other crypto assets while setting up your crypto inheritance plan.

How to protect privacy while planning crypto inheritance

While preparing for the future is crucial, safeguarding privacy during the process is equally vital. When creating a digital asset will, sharing sensitive information can pose risks.

Here are ways to protect your personal and digital information while ensuring posthumous crypto recovery:

-

Avoid including sensitive details in public wills: Do not list private keys, wallet addresses, or access codes in public legal documents. Instead, acknowledge your digital assets without disclosing specific information.

-

Use sealed letters or encrypted files: Provide critical access information through sealed envelopes or encrypted documents, ensuring only trusted individuals can access it when necessary.

-

Explore decentralized identity tools for secure access: Utilize decentralized identifiers (DIDs) or verifiable credentials to manage and transfer access rights safely across platforms, ensuring long-term security.

Why you need to regularly review and update your crypto inheritance plan

A cryptocurrency inheritance plan requires ongoing attention; it is not a one-time task. As digital assets and personal situations change, regular updates in line with your crypto legal advice are essential for maintaining accuracy and effectiveness.

Here are several reasons to review and update your crypto estate planning regularly:

-

Cryptocurrency values and holdings may shift: The value of digital currencies can fluctuate, and you may buy or sell assets over time. Periodic reviews help ensure your plan reflects your current portfolio.

-

Wallets and exchanges may become outdated: Technology evolves rapidly, and certain wallets or crypto exchanges may become obsolete or cease supporting specific tokens. Ensure your instructions are practical and up to date.

-

Revise the plan after major life events: Changes such as marriage, divorce, or the birth of a new heir may influence your intended beneficiaries or asset distribution. Update your digital asset will after such events to keep it legally and personally relevant.

Did you know? Crypto enthusiasts sometimes implement “dead man’s switches.” These systems automatically transfer funds if the owner fails to log in for a specified duration. While innovative, they should be paired with legal documents to prevent disputes and premature triggers.

Crypto inheritance plan: Custodial vs. non-custodial wallets

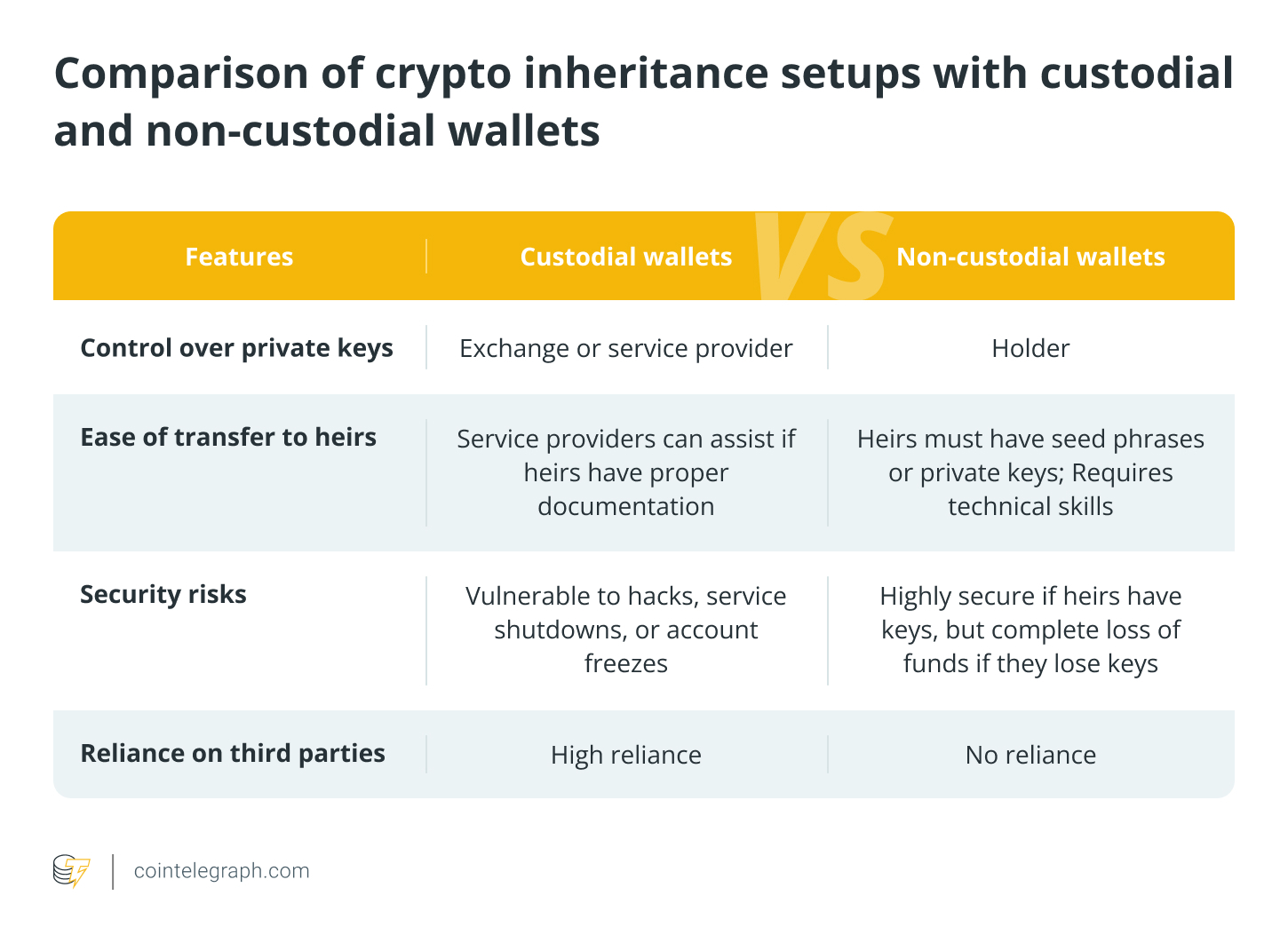

Establishing a cryptocurrency inheritance plan requires understanding the difference between custodial and non-custodial wallets.

Custodial wallets are managed by third parties, such as exchanges that retain the private keys. This may simplify access for heirs with proper documentation and support, but involves risks, including hacks, account freezes, or service discontinuation.

Conversely, non-custodial wallets give users complete control by storing private keys locally. While suited for long-term security, they require careful planning. If heirs misplace the seed phrase or lack technical knowledge, assets may become inaccessible.

A balanced strategy is ideal for inheritance. Non-custodial wallets offer greater security and control, while custodial services facilitate easier transfers.

Comparison of crypto inheritance setups with custodial and non-custodial wallets

How to avoid common crypto inheritance mistakes

Establishing a cryptocurrency inheritance plan is vital, but certain errors can undermine its effectiveness. Avoiding these mistakes ensures your assets remain secure and accessible when needed.

Here are several mistakes to steer clear of when setting up a crypto inheritance plan:

-

Including seed phrases in wills or unsecured documents: Listing private keys or seed phrases in unprotected documents risks theft or misuse. Instead, opt for encrypted storage or secure offline methods.

-

Failing to educate heirs: Even with thorough documentation, heirs unfamiliar with cryptocurrency may have difficulty accessing or managing assets. Provide clear guidance on wallets and transfers.

-

Over-relying on centralized exchanges: Exchanges may close, become compromised, or freeze accounts, rendering them unreliable for long-term storage. Favor self-custody solutions or trusted multisignature wallets for enhanced security.

Crypto estate planning: Safeguarding your digital wealth

A well-structured digital asset will brings confidence by alleviating uncertainty for both asset holders and their heirs. For holders, it guarantees that all their digital assets, including BTC, altcoins, NFTs, or DeFi holdings, are protected from forgotten keys, unreachable wallets, or heirs’ lack of technical knowledge.

A crypto inheritance plan contains records of assets, access instructions, and additional legal documents that protect your legacy and prevent conflicts.

For beneficiaries, it simplifies the process of accessing assets, relieving them of the stress of navigating a complex and unfamiliar technological landscape. The plan facilitates a smooth wealth transfer through secure storage, reliable executors, and legally compliant documents.

This article does not contain investment advice or recommendations. Every investment and trading action carries risk, and readers should conduct their own research before making decisions.