Key points:

-

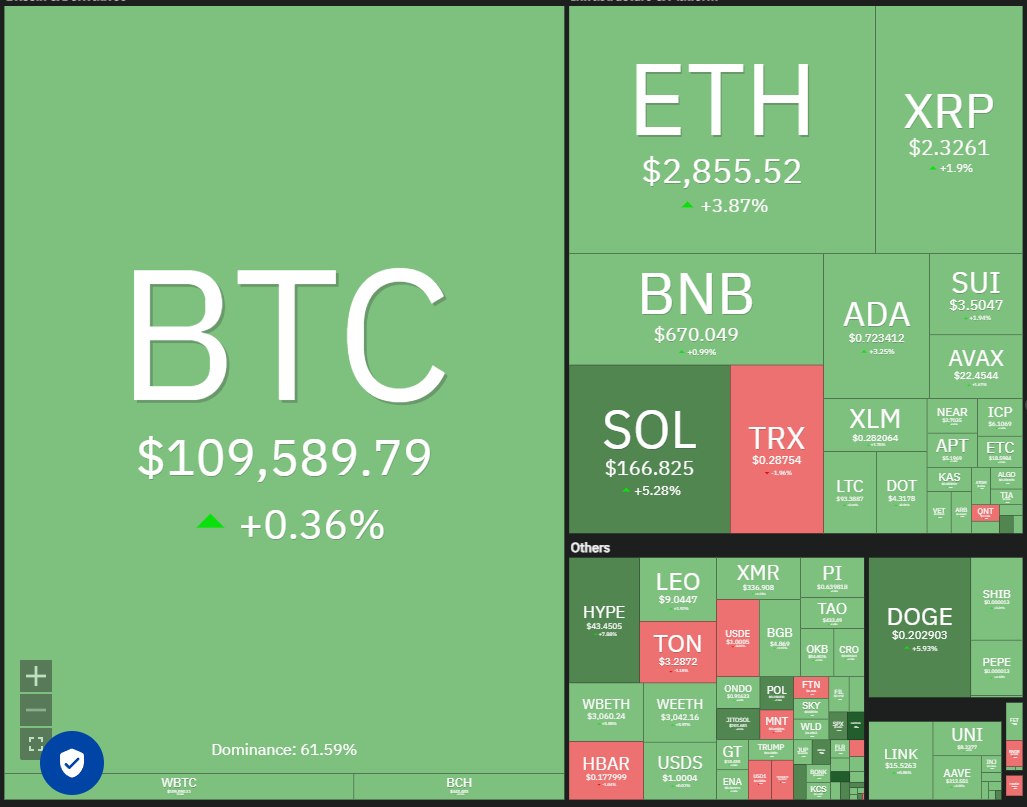

The likelihood of Bitcoin reaching new highs grows as bulls demonstrate a clear intent to defend the $109,000 level.

-

ETH and HYPE are taking the lead among altcoins.

Bitcoin (BTC) has been hovering around the $110,000 mark, just shy of its all-time high of $111,980. This indicates that bulls are holding onto their positions in anticipation of another upward move. Sentiment has been bolstered by a post from US President Donald Trump on Truth Social, announcing that the United States and China have reached a trade agreement pending final approval from both nations’ leaders.

According to Bitwise researchers André Dragosch and Ayush Tripathi, Bitcoin could achieve its estimated “fair value” of $230,000 by year-end. Analysts believe Bitcoin stands to gain from both “fiscal instability and improved market sentiment.”

Nevertheless, not all analysts share the same outlook for Bitcoin in the near term. Santiment analyst Brian Quinlivan indicated to Cointelegraph that a significant bullish surge above the all-time high seems unlikely, as social media buzz often precedes market moves against retail expectations.

Could Bitcoin bulls push the price above $111,980, consequently driving altcoins higher? Let’s examine the charts of the top 10 cryptocurrencies for insights.

Bitcoin price prediction

Bitcoin surged past the $109,588 resistance on Monday, but bulls are facing challenges in maintaining these elevated levels.

A minor pullback increases the chances of breaking above the $111,980 resistance. If this occurs, the BTC/USDT pair will finish an inverted head-and-shoulders pattern, targeting $146,892.

If the price drops below $108,000, the pair risks declining to the 20-day exponential moving average ($106,313). Protecting this level is crucial for bulls; a breach could lead the pair down to the 50-day simple moving average ($102,709) and then to psychological support at $100,000.

Ether price prediction

Ether (ETH) broke and closed above the $2,738 resistance on June 10, indicating bullish attempts to take control.

The 20-day EMA ($2,584) has begun to trend upward, and the RSI is nearing overbought conditions, indicating buyer dominance. Bears will fight hard to pull the price below $2,738. If they succeed, the ETH/USDT pair could fall to the 20-day EMA ($2,584).

Should the price rebound from the 20-day EMA powerfully, the pair may climb to $3,153. While resistance exists at $3,000, it could be overcome. However, if the price declines and breaks below the 20-day EMA, this may signal that the breakout above $2,738 was a bull trap.

XRP price prediction

XRP (XRP) closed above the moving averages on Monday, but bulls are struggling to maintain these higher levels.

The flat moving averages and the RSI hovering just above the midpoint suggest that the XRP/USDT pair might remain range-bound between $2 and $2.65 for several days. If the price closes below the moving averages, it could fall to $2. Conversely, breaking above $2.36 would clear the way for a rally to $2.65.

A close above $2.65 would mark the beginning of a significant upward move toward $3. Conversely, a break below $2 could lead to a drop to $1.61.

BNB price prediction

BNB (BNB) moved above the 20-day EMA ($659) on Monday, with bulls attempting to advance toward the $693 resistance.

The flat 20-day EMA and RSI indicate potential range-bound movement in the near future. The BNB/USDT pair is likely to remain trapped within the $634 to $693 range for a while longer.

A break above the $693 resistance suggests bullish pressure dominating bears. The pair could advance to $732 and then $761. If it drops below $634, the trend would favor the bears.

Solana price prediction

Solana (SOL) surged above the moving averages on Monday, hinting at a potential range between $140 and $185.

The flat 20-day EMA ($160) and the RSI slightly above the midpoint suggest a slight bullish advantage. The SOL/USDT pair could approach $185, where bears are expected to aggressively sell. A sharp downturn from this level might extend the range-bound action for a few more days.

The next major movement could trigger from a breakthrough above $185 or below $140. If the $185 level is surpassed, the pair could rise to $210 and potentially $220.

Dogecoin price prediction

Dogecoin (DOGE) has been consolidating between $0.14 and $0.26 for several days, indicating buying near support and selling close to resistance.

The flat 20-day EMA ($0.19) and RSI near the midpoint do not favor either bulls or bears decisively. If the price remains above the moving averages, the DOGE/USDT pair may rally to $0.26. Conversely, a sudden reversal from the moving averages could pull the pair down to $0.16.

Buyers need to push the price above the $0.26 resistance to initiate a new upward trend toward $0.38.

Cardano price prediction

Cardano (ADA) rose above the 20-day EMA ($0.70) on Monday, with bulls trying to strengthen their hold by pushing the price above the 50-day SMA ($0.72). If successful, the next stop could be the downtrend line.

Bears are unlikely to relent easily and may mount a strong defense at the downtrend line. A significant decline from this level could see the ADA/USDT pair find support at the 20-day EMA. If that occurs, the possibility of breaking above the downtrend line increases, potentially leading to a rally toward $1.03.

Conversely, if the price drops from the current level or the downtrend line and breaks below the 20-day EMA, it would indicate bearish control at higher prices. This may keep the pair confined within the $0.60 support and the downtrend line for several days.

Related: SOL price toward $300 next? Solana ETF approval chances jump to 91%

Hyperliquid price prediction

Hyperliquid (HYPE) broke and closed above the symmetrical triangle pattern on Monday, signaling the continuation of an uptrend.

The bulls managed to push the price above the formidable resistance at $42.25, opening the pathway for a rise to the target of $46.50 and eventually $50.

Should there be a pullback, bulls are expected to defend the area between $42.25 and $40 vigorously. A rebound from this support range would indicate strong buying interest, affirming the uptrend. The initial warning sign of weakness would be a close below $40, which could pull the HYPE/USDT pair to the 20-day EMA ($35.21).

Sui price prediction

Sui (SUI) broke through the 20-day EMA ($3.40) on Monday, with bulls trying to lift the price above the 50-day SMA ($3.55) on June 11.

If successful, the SUI/USDT pair may rally to $3.75 and later $4.25. Sellers are expected to defend the $4.25 level aggressively. A sharp decline from this price point could lead to a range formation, oscillating between $2.86 and $4.25 for some time.

The next significant movement may result from a break above $4.25 or below $2.86. Until then, price action is likely to remain unpredictable and volatile.

Chainlink price prediction

Chainlink (LINK) surged above the resistance line of the descending channel and the moving averages on Tuesday, indicating a loss of bearish grip.

If the price holds above the breakout level, the LINK/USDT pair may gain momentum and rally to $18. Sellers will attempt to defend this level, but if bulls prevail, the pair could soar to $20.

This optimistic outlook will be reversed if the price drops back and falls below the $13.20 support, indicating that the market has rejected the breakout. The pair could then decline to $10.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.