Key points:

-

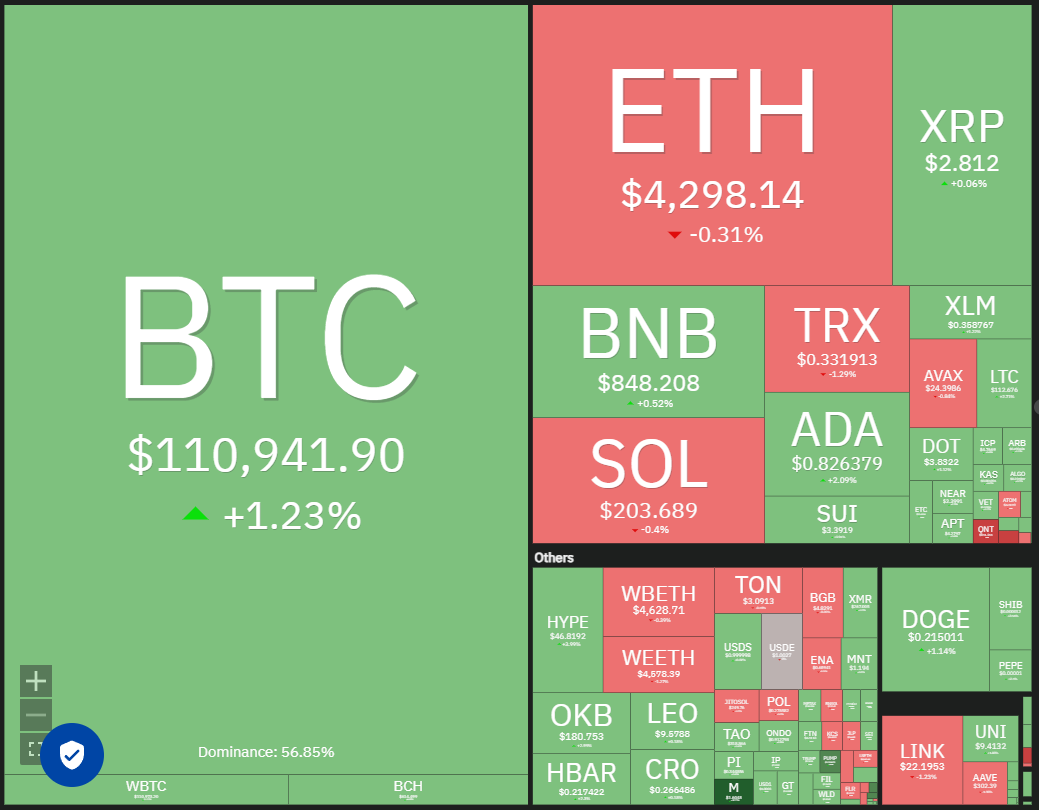

Bitcoin surged past $113,000 on Friday, but the long candlestick wick indicates significant selling at elevated levels.

-

Many major altcoins are attempting to maintain their support levels, but selling pressure from bears persists.

On Thursday, sellers pushed Bitcoin (BTC) below $110,000, but buyers capitalized on the dip, driving the price above $113,000 on Friday. The higher prices attracted selling from bears, who are trying to reverse BTC back below $110,000.

According to Glassnode’s latest The Week Onchain Report, a critical level for BTC to monitor upwards is $116,000. If buyers can break through this resistance, BTC may begin its next upward movement. Conversely, if the $104,000 level fails to hold, BTC could drop to the $93,000 to $95,000 range.

Key points:

-

Bitcoin surged past $113,000 on Friday, but the long candlestick wick indicates significant selling at elevated levels.

-

Many major altcoins are attempting to maintain their support levels, but selling pressure from bears persists.

On Thursday, sellers pushed Bitcoin (BTC) below $110,000, but buyers capitalized on the dip, driving the price above $113,000 on Friday. The higher prices attracted selling from bears, who are trying to reverse BTC back below $110,000.

According to Glassnode’s latest The Week Onchain Report, a critical level for BTC to monitor upwards is $116,000. If buyers can break through this resistance, BTC may begin its next upward movement. Conversely, if the $104,000 level fails to hold, BTC could drop to the $93,000 to $95,000 range.

Alphractal founder and CEO Joao Wedson stated in a post on X that BTC’s fractal cycle might conclude in October 2025, although a rise to $140,000 is still possible. If BTC peaks in October, it could enter a bear market in 2026, potentially falling below $50,000. Wedson expressed interest in whether BTC’s four-year cycle has ended due to strong interest from exchange-traded funds and institutional investors, as some analysts suggest.

What are the key support levels to monitor for BTC and major altcoins? Let’s examine the charts of the top 10 cryptocurrencies to find out.

Bitcoin price prediction

BTC bulls managed to push the price above the 20-day exponential moving average ($112,093), but could not maintain the momentum.

Sellers will need to swiftly pull the price below $109,000 to retain their edge. Should this occur, BTC may drop to $107,250, a crucial level to observe. If this support fails, the BTC/USDT pair could fall to $105,000 and later $100,000.

For buyers, pushing and sustaining the price above the 20-day EMA is essential for demonstrating strength. This could lead to a rise toward the 50-day simple moving average ($115,304), which may draw sellers back in. Should buyers surpass this challenge, the rally could reach $120,000 and ultimately $124,474.

Ether price prediction

ETH (ETH) has been trading within a tight range between $4,500 and $4,250 for the last several days, indicating balance between supply and demand.

The flat 20-day EMA and an RSI near the midpoint do not provide a significant advantage to either bulls or bears. If the price rises above $4,500, it would signal a return of bullish momentum. The ETH/USDT pair could then rally to $4,664 and subsequently $4,957.

On the other hand, if the price falls below $4,250, the pair may decline to the breakout level of $4,094. Buyers are expected to defend this level strongly, as a breakdown could see Ether price sink to $3,745.

XRP price prediction

XRP (XRP) has established a descending triangle pattern, which will complete upon a break and close below $2.73.

The downsloping 20-day EMA ($2.90) and an RSI just below the midpoint suggest a seller advantage. If the price sharply declines from the 20-day EMA, the likelihood of falling below $2.73 increases, potentially sending the XRP/USDT pair down to $2.20.

Conversely, a break above the 20-day EMA indicates that bears are losing their grip. XRP’s price may then test the downtrend line, where strong selling pressure is anticipated. A break and close above this line would negate the bearish setup, paving the path for a rise to $3.40 and then $3.66.

BNB price prediction

BNB (BNB) is experiencing a tough struggle between bulls and bears at the 20-day EMA ($848).

With the 20-day EMA flat and RSI just above the midpoint, there’s no clear advantage for either side. If the price drops below $840, the next stop might be the 50-day SMA ($816). Buyers will likely attempt to halt the pullback within the range between the 50-day SMA and the $794 level.

The first sign of bullish strength will be a close above $881, indicating that buyers are regaining control. The BNB price could then gain momentum above $900 and potentially reach $1,000.

Solana price prediction

Solana (SOL) declined from the $210 level on Thursday but is currently finding support at the 20-day EMA ($198).

Bulls will aim to assert control by pushing the price above the $218 resistance. A successful breakout would complete a bullish ascending triangle pattern, initiating a new upward movement to $240 and ultimately $260.

If sellers manage to pull the price below the uptrend line, it would invalidate this bullish outlook. The pair might then retreat to $175 and later to $155, where buyers are expected to intervene. This could confine Solana’s price between $155 and $218 for a short period.

Dogecoin price prediction

Dogecoin (DOGE) has been trading between the moving averages and the $0.21 support recently.

The steadily declining 20-day EMA ($0.21) and RSI just below the midpoint suggest a slight advantage for the bears. A close below $0.21 would favor the bears, potentially causing the DOGE/USDT pair to drop to $0.19, triggering a larger range between $0.14 and $0.29.

For buyers, pushing Dogecoin’s price above the 50-day SMA ($0.22) is essential to regain strength. If successful, the pair may then rise toward $0.26.

Cardano price prediction

Buyers attempted to push Cardano (ADA) above the 20-day EMA ($0.84) on Friday, but bears held their ground.

Support is positioned at $0.80; however, if this level is breached, the ADA/USDT pair may fall to the support line of the descending channel pattern. A rebound from this support line may face selling pressure at the 20-day EMA, increasing the likelihood of breaking below the support line. In that case, the Cardano price could decline to $0.68.

Alternatively, a close above the 20-day EMA would indicate reduced selling pressure. The pair could then approach the downtrend line, and if buyers manage to break through, it could signal the start of a new upward movement to $1.02.

Related: Bitcoin price ignores major US payrolls miss to erase $113.4K surge

Chainlink price prediction

Chainlink (LINK) reversed from the 20-day EMA ($23.24) on Thursday, suggesting bears are actively defending this level.

Sellers will aim to drive the price down to the 50-day SMA ($21.19), expected to act as robust support. A bounce from the 50-day SMA and a breakout above $24.10 would indicate that bears are losing their grip. The LINK/USDT pair could then rise to $26 and subsequently $28.

If the price breaks and closes below the 50-day SMA, Chainlink could slide toward the uptrend line.

Hyperliquid price prediction

Hyperliquid (HYPE) rebounded off the 20-day EMA ($44.78) on Friday, highlighting solid buying activity from bulls.

If buyers can maintain the price above $46.50, the HYPE/USDT pair might rally toward the $49.88 to $51.19 resistance zone. Sellers are expected to vigorously defend this area; a close above it would complete a bullish ascending triangle pattern, possibly driving the price toward the target of $64.25.

This optimistic perspective could be invalidated if the price declines and falls below the uptrend line, risking a drop to $40 and potentially $35.51.

Sui price prediction

Sui (SUI) retreated from the 20-day EMA ($3.43) on Thursday, but bulls are trying to establish support at $3.26.

Bulls will seek to strengthen their position by pushing Sui’s price above the 20-day EMA. Should they succeed, the SUI/USDT pair could rise to the 50-day SMA ($3.64). This level is crucial, as breaking above it could lead to price fluctuations between $3.26 and $4.44 for an extended period.

For bears, pulling the price below $3.11 is necessary to gain the upper hand. This could result in a drop to $2.80.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.