Key points:

-

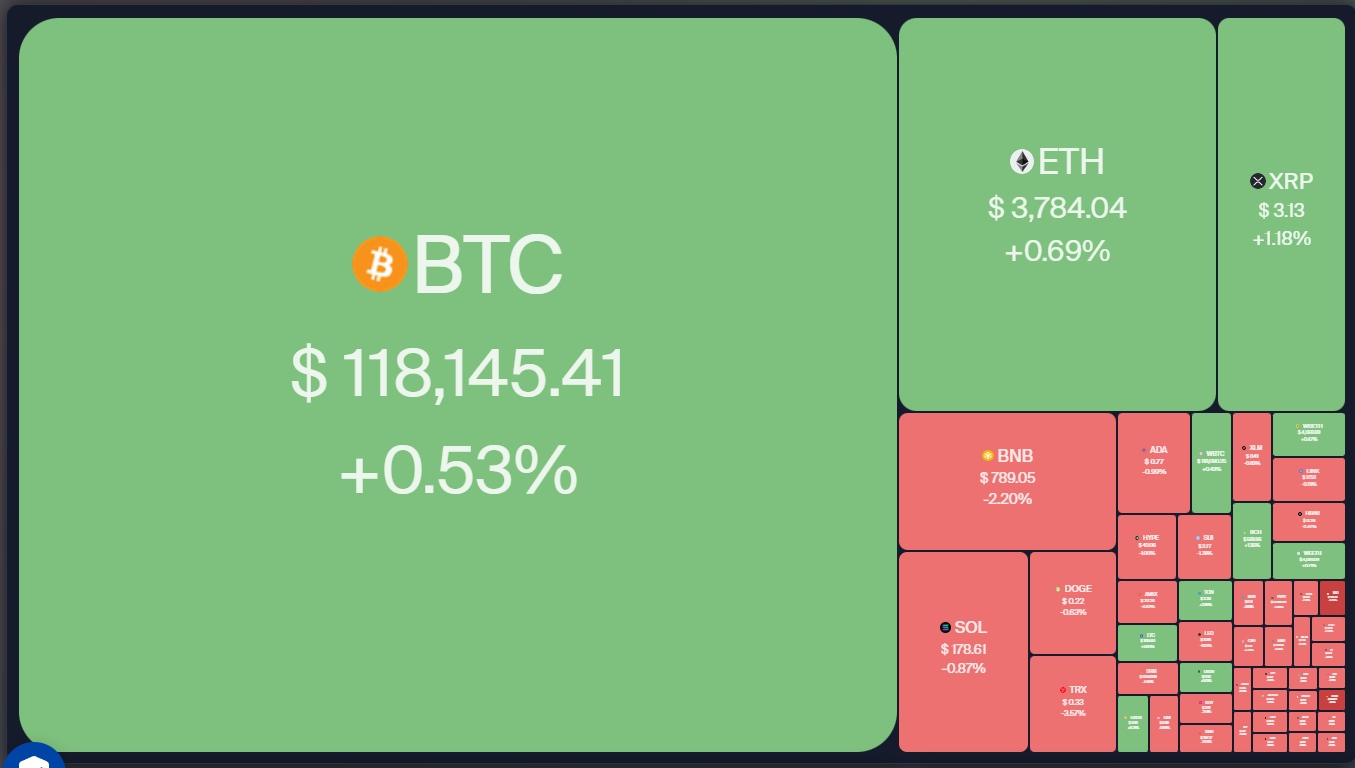

Bitcoin is currently trading in a tight range, indicating a potential breakout may be imminent.

-

The upcoming FOMC minutes and the Federal Reserve’s interest rate decision could influence directions for the crypto market.

Bitcoin (BTC) is hovering around the $120,000 resistance level, reflecting sustained bullish momentum. Despite its strong positioning, seasonal trends may present challenges. Historical data from Axel Adler Jr. shows that BTC has only averaged a 2.56% return in August over the last 13 years.

Nevertheless, short-term uncertainties and August’s historical performance haven’t discouraged Strategy from increasing its BTC holdings. On Tuesday, the firm disclosed it had purchased 21,021 BTC at an average price of $117,256, raising its total to 628,791 BTC.

While BTC consolidates, Ether (ETH) and BNB (BNB) are gaining traction. Glassnode noted in a post on X that ETH’s perpetual futures volume has now surpassed that of BTC, marking a notable shift in speculative interest towards altcoins.

Will BTC break out of its current range? Will select altcoins extend their upward trajectory? Let’s delve into the charts of the top 10 cryptocurrencies for clarity.

Bitcoin price prediction

BTC continues to fluctuate within a tight band between $115,000 and $120,000. A prolonged stay in this narrow range typically leads to a significant breakout.

The upward-trending 20-day simple moving average ($118,313) and a positive relative strength index (RSI) suggest an upward bias. If buyers push the price above $120,000, the BTC/USDT pair could gain momentum, possibly reaching new heights beyond $123,218, and target $135,000.

Conversely, a drop and subsequent close below $115,000 would indicate that bears have taken control, potentially driving the price down to $110,530. This level is crucial as a breach could lead to a decline towards $100,000.

Ether price prediction

ETH is attempting to maintain its position above the breakout level at $3,745, indicating that bulls remain optimistic for further gains.

Should the price rebound from the $3,745 support, the ETH/USDT pair is likely to approach the overhead resistance at $4,094. Sellers are expected to challenge this level significantly; however, if bulls succeed, a surge toward $4,868 is possible.

On the other hand, a decline below $3,745 would suggest waning bullish interest, potentially pulling the price down to the 20-day SMA ($3,516), where buyers are anticipated to enter the market. A strong rebound from the 20-day SMA could see the bulls attempt another challenge at overhead resistance.

XRP price prediction

XRP (XRP) is facing a challenging contest between buyers and sellers around the 20-day SMA ($3.16).

If the price dips below the $3.05 support, the next target could be $2.95. Buyers are expected to defend this level fiercely, as slipping below it could trigger a deeper correction toward $2.65.

Conversely, a robust rebound from the $2.95 level may indicate strong demand at lower price points. While the 20-day SMA may serve as resistance on the way up, overcoming it could enable the XRP/USDT pair to rise to $3.33 and further to $3.66.

BNB price prediction

BNB has retraced to the breakout level of $794, which serves as a vital support zone to monitor.

If the price bounces back from $794, it indicates that bulls are attempting to turn this level into support. Should this occur, the BNB/USDT pair might revisit the all-time high of $861. A sustained close above $861 could trigger the next phase of the uptrend toward $900.

In contrast, a close below the $794 level would suggest profit-taking by short-term traders and could pull the price down to the 20-day SMA ($751), which may draw in buyers. Sellers would need to push the pair below the 20-day SMA to regain control.

Solana price prediction

Solana (SOL) has retraced to the 20-day SMA ($178), which is likely to provide robust support.

A strong rebound off the 20-day SMA could see bulls pushing the SOL/USDT pair toward the overhead resistance of $209. A decisive close above $209 could pave the way for a rally to $240, although minor resistance exists at $220.

Alternatively, a drop below the 20-day SMA could lead the price to the 50-day SMA ($160), suggesting the pair may remain confined between $110 and $209 for several days.

Dogecoin price prediction

Dogecoin (DOGE) faced selling pressure as it turned down from $0.25 on Monday and subsequently fell below the 20-day SMA ($0.22) on Tuesday.

The upcoming support is at $0.21. If the price bounces back from $0.21 and surges above the 20-day SMA, the bulls will aim for $0.26 and then $0.29. However, sellers are expected to defend the $0.29 level vigorously, as a close above it may drive the price to $0.35 and ultimately $0.44.

Conversely, a close below $0.21 could pull the pair down to the 50-day SMA ($0.19), suggesting it may linger within the broader range of $0.14 to $0.29 for a while longer.

Cardano price prediction

Cardano (ADA) fell below the 20-day SMA ($0.79) on Tuesday, indicating that bears are gaining traction.

Support is found at $0.76; however, if this level fails, the ADA/USDT pair may extend its decline to $0.73 and then to the 50-day SMA ($0.67). Such a decrease suggests the pair might remain within the $0.50 to $0.86 range for some time.

A positive sign would be a break and close above the 20-day SMA, implying decreased selling pressure at lower levels, allowing bulls to strive for a push above the $0.86 resistance.

Related: $3 price at risk? Why XRP was one of the worst performers this week

Hyperliquid price prediction

Hyperliquid (HYPE) has been positioned between the support line of an ascending channel and the 20-day SMA ($45.13).

The bulls’ inability to push the price above the 20-day SMA raises the risk of a break below the support line. Should this occur, the HYPE/USDT pair could decline to $36 and possibly $32 afterward.

This negative outlook may change if the price turns upward and crosses above the 20-day SMA, potentially leading the pair to the resistance zone between $48 and $49.87.

Stellar price prediction

Stellar (XLM) fell below the 20-day SMA ($0.44) on Monday, and the bears defended this level during a subsequent test on Tuesday.

The bears aim to strengthen their grip by pushing the price below $0.40. If successful, the XLM/USDT pair could drop to the 50% Fibonacci retracement level of $0.37 and subsequently to the 61.8% level at $0.34.

Buyers, however, are likely to attempt a comeback by driving the price above $0.46. If they succeed, the pair could retest the overhead resistance of $0.52, with the next rally potentially starting from a close above $0.52 toward $0.64.

Sui price prediction

Sui (SUI) managed to exceed the $4.30 resistance on Sunday, but this breakout quickly turned out to be a bull trap as the price sharply declined on Monday.

Bears are trying to maintain the price below the 20-day SMA ($3.85). If they succeed, the SUI/USDT pair may drop to $3.51, with buyers expected to defend the region between $3.51 and the 50-day SMA ($3.27).

If the price rallies from $3.51 and surpasses the 20-day SMA, this could indicate a potential range formation. The pair may oscillate between $3.51 and $4.30 for a time, and a decisive close above $4.30 could initiate a new upward trend toward $5.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.